Author Archives: bcpoa

Property Tax Rebates & Assessments

Collecting your rebate

The enrollment period for collecting your property tax rebate is now open. This involves some absurdly bureaucratic form-filling, but it should be worth it.

Before you start, you may need:

- A glass of your favorite beverage – this might take a while.

- Your property GeoCode. This is a 17-digit number on your property tax bill, but you can also look it up on the MT Cadastral map.

- You must certify that you’ve lived in this residence for 7 months and paid the taxes.

- An unstated assumption seems to be that rebates are one per household and available only for parcels classified with a dwelling. So, if you have more than one parcel, be sure to get the GeoCode for the principal residence.

- Your property tax bills (for the total paid in 2022). Be sure to enter the total of both halves of the year.

- Your property tax rebate notice letter. (You can skip this with no ill effect it seems, but they request an ID number from the letter.)

- Your social security number. Presumably this needs to match the listed owner of the parcel.

- Your MT income taxes (for questions about dependents and filing status).

To apply, visit the Property Tax Rebate link at the MT DOR transaction portal.

If you need documentation, or have other property tax questions, they’re administered by the Gallatin County Treasurer’s Tax Division.

The Assessment Mess

You’ve probably seen headlines to the effect that the legislature increased property taxes 40% this year. I’ve seen a variety of numbers between 30% and 43%. The legislature didn’t raise tax rates, but total taxes are likely to go up, because assessments are way up. However, it’s not a simple process: there are offsetting limits on county mill rates that partially compensate for the increased assessment.

Compounding this problem, the state has evidently not been following its own statutory requirements for school levies, which are set by the state. Broadwater County has asked the Attorney General, Austin Knudsen, for an opinion clarifying the situation and constraining the state to follow statute. The Montana Association of Counties has written a scathing letter to Gov. Gianforte, expressing unanimous support for Broadwater’s request, and dismay at the legislature’s failure to manage this situation. Excerpts:

Many of your statements indicate that local governments need to show more fiscal restraint

or “greater fiscal responsibility,” as you have often repeated. You seem to imply that appreciating home values, through your Department of Revenue reappraisal process, should compel local governments to mitigate the impacts when setting mill levies. While this is a great talking point and sounds good in theory, the message is misleading at best and overlooks the fact that county mills are capped by the provisions of MCA 15-10-420. When appraised values increase significantly and the taxable values of the jurisdiction rise, the number of mills we are authorized to levy decreases. Therefore, appreciating values actually decrease our levy authority.During the legislative session, both the Legislature and your administration had the opportunity to further mitigate the impacts of reappraisal but elected not to do so. The Legislature controls the rate at which Class 4 Property is taxed, and when increases in appraised values for Class 4 Property are forecasted, as they were before the 2023 session, mitigation was an option. The rapid increase in residential property in Montana will result in a TAX REDUCTION for all other classes of property for county mills because we are mill-levy limited. Montana counties will levy less mills next year on all classes of property as a result of reappraisal. Residential property valuation increases will outpace all other classes, and the net result will be a reduction in all other classes because residential properties will shoulder a larger percentage of the total taxable value in any taxing jurisdiction. This is how our tax system works in Montana, and telling local governments to show greater fiscal restraint does not stop the burden from shifting to residential property taxpayers.

The letter further explains in detail how the mill levy formulas work in Montana.

I’m not sure we should hold our breath on this one. Apparently AG Knudsen has at best two weeks to act. He’s broken Tim Fox’s record for fewest opinions written per year, perhaps because he’s too busy defending the TikTok ban. Perhaps he needs a little encouragement:

DOJ email: contactdoj@mt.gov

DOJ contact form: https://dojmt.gov/about/

AG phone: 444-2026

Gov. Gianforte: governor@mt.gov

Gov. phone: 444-3111

2023 General Meeting

We had a terrific turnout and interesting discussions. Great to see everyone!

Slides are here:

BCPOA 2023 Newsletter

Get it here: BCPOA newsletter 2023.pdf

Property Tax Relief

One attractive outcome of this year’s legislative session is property tax relief. From the Department of Revenue:

https://mtrevenue.gov/taxes/2023-montana-tax-rebates/

Property Tax Rebate (HB222)

What is the Property Tax Rebate?

The Property Tax Rebate is a rebate of up to $500 a year of property taxes on a principal residence paid for 2022 and 2023.How much is the Property Tax Rebate?

For each year, the rebate is the lesser of:

the actual amount of property tax you paid for your principal Montana residence, or

$500.The 2022 Property Tax Rebate is a rebate of property taxes assessed and paid on the bill that had the first-half payment due in November 2022 and the second-half payment due in May 2023.

The 2023 Property Tax Rebate is a rebate of property taxes assessed and paid on the bill that had the first-half payment due in November 2023 and the second-half payment due in May 2024.What are the qualifications?

You qualify for a Property Tax Rebate if you:

owned and lived in a Montana property as your principal residence for at least 7 months of each year, and

were assessed and paid property taxes on this residence in the relevant tax year(s).How do I claim a rebate?

Taxpayers may claim the 2022 rebate online through our TransAction Portal or by paper form beginning August 15, 2023. The claim must be filed by October 1, 2023.

Taxpayers may claim the 2023 rebate online through our TransAction Portal or by paper form beginning August 15, 2024. The claim must be filed by October 1, 2024.

I think the Transaction Portal is not set up to handle this yet, but presumably by the open filing date (August 15) in will be clear what to do.

Gallatin County Hazardous Fuel Mitigation Grants

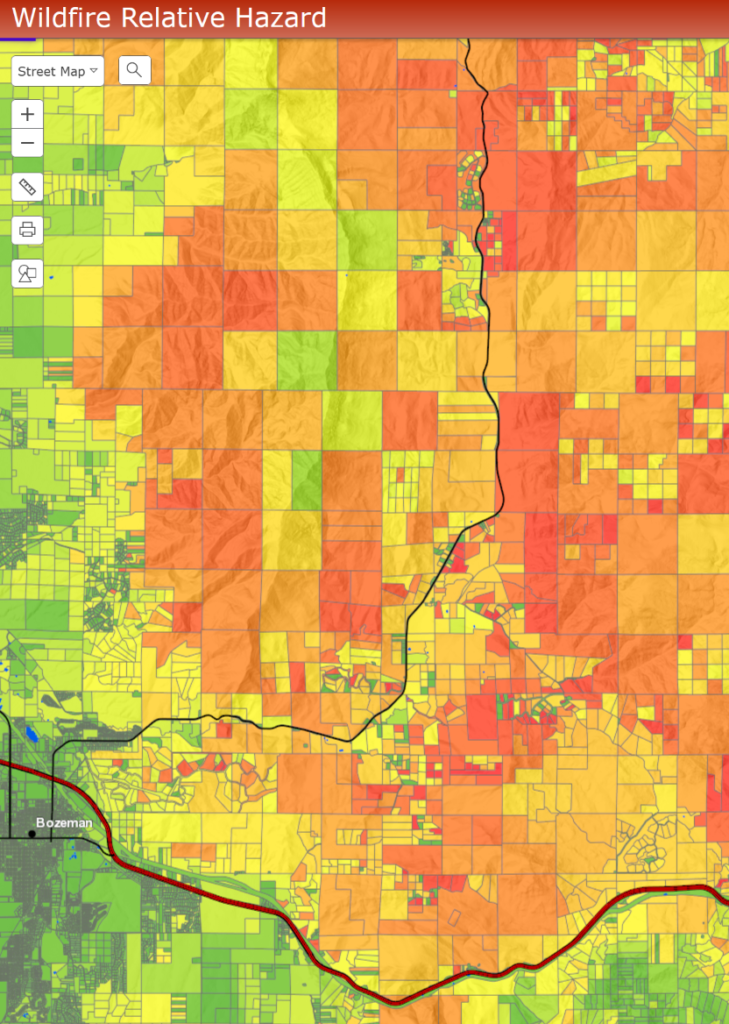

Last month, Jay Pape of Gallatin County Emergency Management joined us for a discussion of fire mitigation funding that’s now available in Gallatin County. This looks like a good opportunity with a high copay, and the requirements are not burdensome.

Gallatin County has received funding to help property owners in the Bridger Canyon project area reduce the risk of wildfire impacts to their homes.

Studies have shown that treating the area within 100’ of your house greatly reduces the potential impacts of a wildfire (see the attached flyer). To be clear- this is not a program that asks homeowners to clear cut their properties.

If you are interested in participating in this program, you can request a FREE Home Risk Assessment. Gallatin County staff will meet with you for the assessment and develop a treatment prescription. Projects could range from hand thinning areas just around their home and structures to larger, forest thinning type projects- depending on property size and continuity with neighbors.

Homeowners may then apply for a grant that will cover 60% of their out-of-pocket expenses. If the grant is awarded, we will provide list of contractors. A service contract is then developed between the Property Owner and the Contractor. After the work has been performed as defined in the prescription, the property owner pays the Contractor in full and submits a reimbursement request to Gallatin County for 60% of the total cost.

For more information and to sign up for your FREE Home Risk Assessment, go to: www.readygallatin.com/mitigation, email mitigation@readygallatin.com, or call 406-548-0118.

2022 Bridger Canyon Picnic September 11th

2022 Newsletter & General Meeting

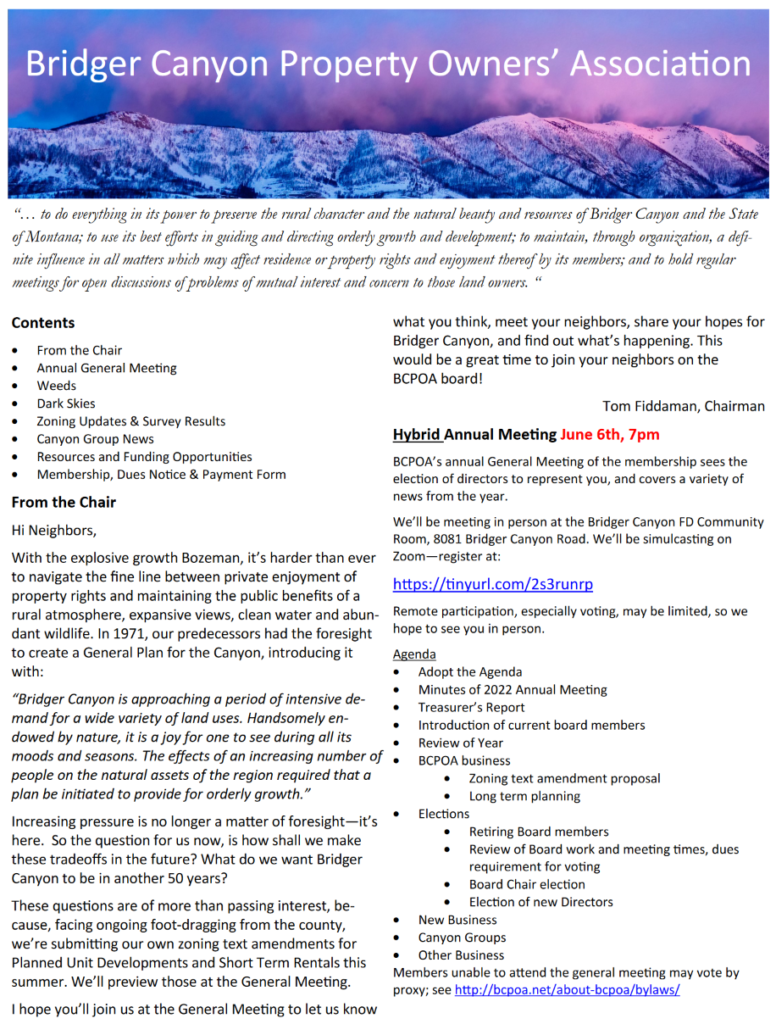

Be sure to take the survey!

The annual General Meeting is Tue, June 28, 7:00 pm on Zoom – register here.

Survey – Future Bridger Canyon

Bridger Canyon Propane Buying Group

By now, most of you have probably heard of and, hopefully, are benefiting from the Bridger Canyon Propane Buying Group (BCPBG). We are now in our 18th year and have more than 200 participants that save money and time each year by being enrolled in the program. If you didn’t already know or you are new to the Canyon, the cost-saving program was created in 2003 by former-Canyon resident Ken Keyes with the goal of obtaining an annual, competitive, fixed-price term contract for folks living in Bridger Canyon. Ken started with four neighbors initially, and the group continues to grow every year.

The simple program consists of Bridger Canyon homeowners who sign up (pledge) to participate in the buying group. Soon I will be emailing current participants the 2021-2022 program details of summer and winter-fill pricing and the supplier. Typically, summer fills are at a lower price than winter fills and run from June 1st to the last business day of August. Winter fills start September 1st and go through the last business day of May.

Once a homeowner has registered with the BCPBG, each year they will be automatically enrolled for the following year. I will handle the contract signing on behalf of all participating members/homeowners, so after the initial sign-up, the headache of searching for the best price from different propane suppliers is a thing of the past. Suppliers also have the capability to monitor your tank(s) if you are away or are only a part-time resident so one never has to worry about running out of propane. It’s a win-win decision for all involved.

If you are not yet signed up and may be interested in receiving more information, please email me: bridgerpropane@gmail.com If you are signed up and have not yet received the 2022-2023 contract details by June 1, 2022, please email me.

Kim Marchwick – bridgerpropane@gmail.com

Twitter

Twitter Facebook

Facebook RSS

RSS Email

Email