Get it here: BCPOA newsletter 2023.pdf

Monthly Archives: May 2023

Property Tax Relief

One attractive outcome of this year’s legislative session is property tax relief. From the Department of Revenue:

https://mtrevenue.gov/taxes/2023-montana-tax-rebates/

Property Tax Rebate (HB222)

What is the Property Tax Rebate?

The Property Tax Rebate is a rebate of up to $500 a year of property taxes on a principal residence paid for 2022 and 2023.How much is the Property Tax Rebate?

For each year, the rebate is the lesser of:

the actual amount of property tax you paid for your principal Montana residence, or

$500.The 2022 Property Tax Rebate is a rebate of property taxes assessed and paid on the bill that had the first-half payment due in November 2022 and the second-half payment due in May 2023.

The 2023 Property Tax Rebate is a rebate of property taxes assessed and paid on the bill that had the first-half payment due in November 2023 and the second-half payment due in May 2024.What are the qualifications?

You qualify for a Property Tax Rebate if you:

owned and lived in a Montana property as your principal residence for at least 7 months of each year, and

were assessed and paid property taxes on this residence in the relevant tax year(s).How do I claim a rebate?

Taxpayers may claim the 2022 rebate online through our TransAction Portal or by paper form beginning August 15, 2023. The claim must be filed by October 1, 2023.

Taxpayers may claim the 2023 rebate online through our TransAction Portal or by paper form beginning August 15, 2024. The claim must be filed by October 1, 2024.

I think the Transaction Portal is not set up to handle this yet, but presumably by the open filing date (August 15) in will be clear what to do.

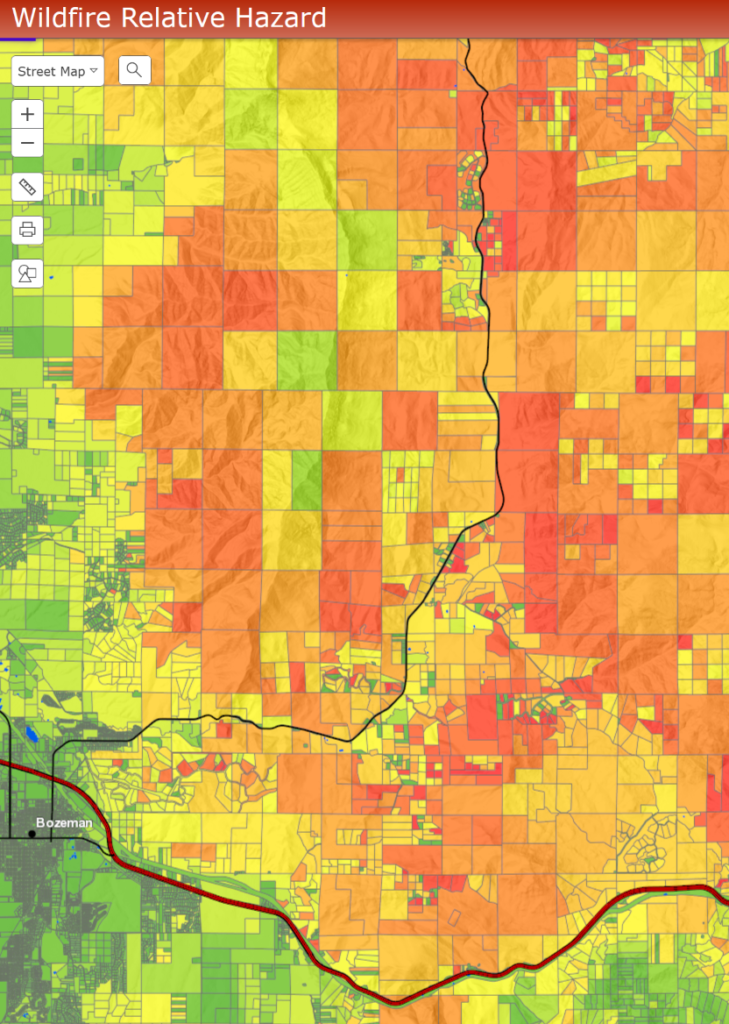

Gallatin County Hazardous Fuel Mitigation Grants

Last month, Jay Pape of Gallatin County Emergency Management joined us for a discussion of fire mitigation funding that’s now available in Gallatin County. This looks like a good opportunity with a high copay, and the requirements are not burdensome.

Gallatin County has received funding to help property owners in the Bridger Canyon project area reduce the risk of wildfire impacts to their homes.

Studies have shown that treating the area within 100’ of your house greatly reduces the potential impacts of a wildfire (see the attached flyer). To be clear- this is not a program that asks homeowners to clear cut their properties.

If you are interested in participating in this program, you can request a FREE Home Risk Assessment. Gallatin County staff will meet with you for the assessment and develop a treatment prescription. Projects could range from hand thinning areas just around their home and structures to larger, forest thinning type projects- depending on property size and continuity with neighbors.

Homeowners may then apply for a grant that will cover 60% of their out-of-pocket expenses. If the grant is awarded, we will provide list of contractors. A service contract is then developed between the Property Owner and the Contractor. After the work has been performed as defined in the prescription, the property owner pays the Contractor in full and submits a reimbursement request to Gallatin County for 60% of the total cost.

For more information and to sign up for your FREE Home Risk Assessment, go to: www.readygallatin.com/mitigation, email mitigation@readygallatin.com, or call 406-548-0118.

Twitter

Twitter Facebook

Facebook RSS

RSS Email

Email